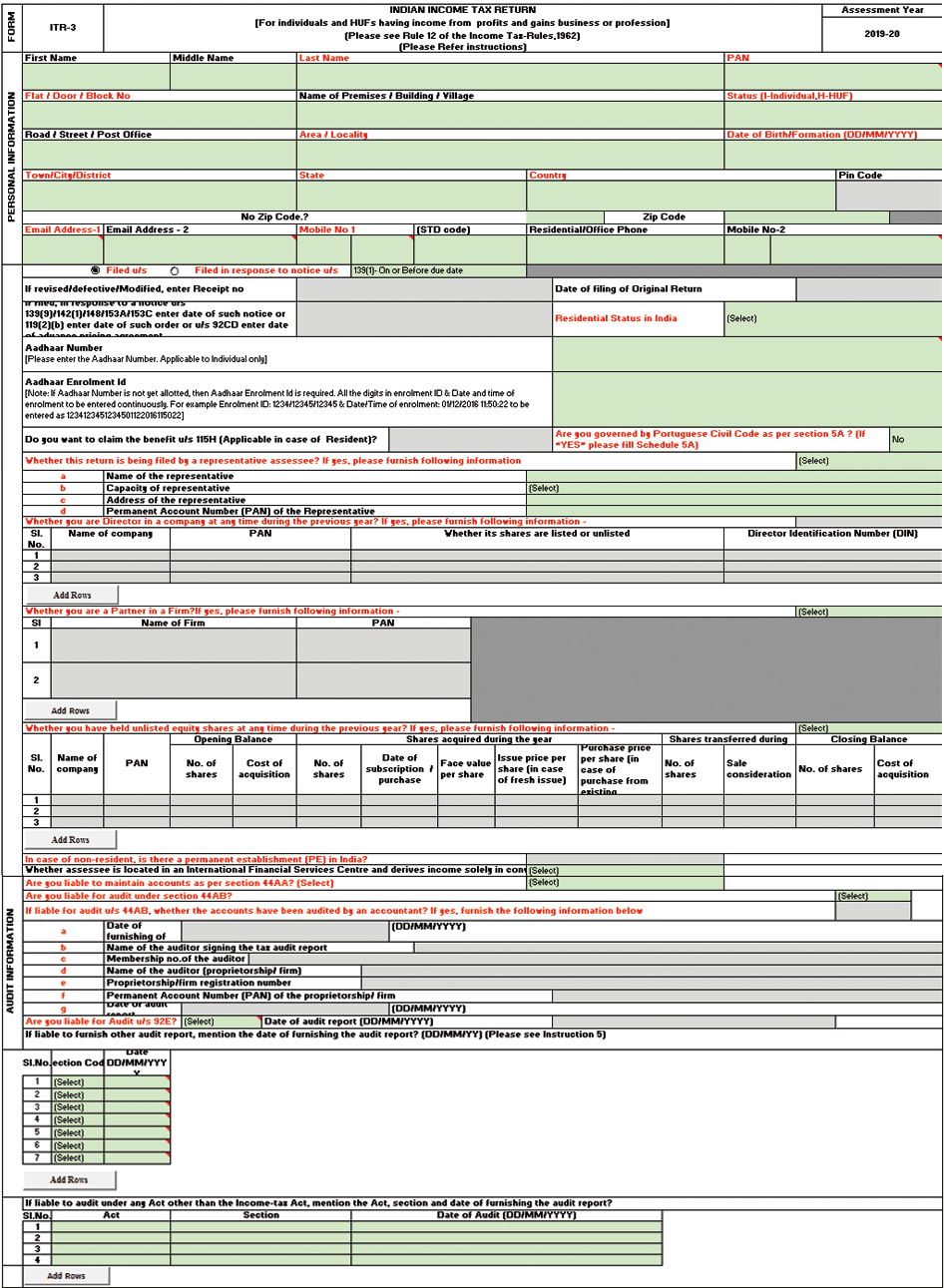

What is ITR 3 Form?

The ITR 3 is meant for persons and HUF who earn their income, profits and gains from business or profession. This means individuals who generate income from the below two sources are should file ITR 3

- Have a business or profession

- Generate income from your property such as house, salary/pension and other sources

Who is eligible for filing ITR Form 3?

- People who belong to the following category are eligible to file their returns through ITR form 3

- Part of an inherited business or Profession

- Drawing income from property, salary/pension from other sources.

- Individuals and Hindu Undivided Family can file their return through ITR form 3 if their total income includes:

- Income from a single or multiple House Property

- Income from short or long-term capital gains

- Income from business or profession practised under a proprietorship firm owned by the individual or the HUF

- Income from winning a lottery, betting on races and other legal forms of gambling Income from foreign assets belonging to the individual.

The structure of ITR 3 form is divided into 2 parts and 23 schedules:

GEN: General information and Nature of Business

BS: Balance Sheet as of March 31, 2018 of the Proprietary Business or Profession

P & L: Profit and Loss for the Financial Year 2017-18

OI: Other Information (optional if you are not eligible for audit under

Section 44AB)

QD: Quantitative Details (optional if you are not eligible for audit under Section 44AB)

Part B summarizes the total income and tax computation with respect to income chargeable to tax.

Income Tax Rate for Individuals – AY 2019-20

Individuals are required to file income tax return each year if they have taxable income of more than Rs.2.5 lakhs. The income tax rate AY 2019-20 or FY 2018-19 for salaried individuals is as follows.

Note: Financial year starts from 1st April and ends on 31st March. For example, the financial year 2018 – 19 would be 1st April 2018 to 31st March 2019. Assessment year is the year immediately following the financial year wherein the income of the financial year is assessed. Hence, in the assessment year 2019 – 20 the income tax for the period from 1st April 2018 to 31st March 2019 would be assessed.

Income Tax Rate for Individuals – AY (Current Year) 2019-20

- Income Tax Rate

AY 2019-20 | FY 2018-19

Individuals less than 60 years - TAXABLE INCOMETAX RATE

- Up to Rs. 2,50,000Nil

- Rs. 2,50,000 to 5,00,0005 %

- Rs. 5,00,000 to 10,00,00020%

- Above Rs. 10,00,00030%

- Income Tax Rate

AY 2019-20 | FY 2018-19

Individuals betwen 60 years and 80 years - TAXABLE INCOMETAX RATE

- Up to Rs. 3,00,000Nil

- Rs. 3,00,000 to 5,00,0005 %

- Rs. 5,00,000 to 10,00,00020%

- Above Rs. 10,00,00030%

- Income Tax Rate

AY 2019-20 | FY 2018-19

Individuals above 80 years - TAXABLE INCOMETAX RATE

- Up to 5,00,000Nil

- Rs. 5,00,000 to 10,00,00020%

- Above Rs. 10,00,00030%

- Above Rs. 10,00,00030%

Surcharge: 10% of income tax, where total income exceeds Rs.50 lakh up to Rs.1 crore.

Surcharge: 15% of income tax, where the total income exceeds Rs.1 crore.

Health & Education Cess: 4% of Income Tax. (Newly introduced through 2018 Budget)

Why Choose Chennai Filings ?

EASY TO ACCESS

BEST EXPERTS

TAX SAVING

LESS TIME

LOW COST IN INDUSTRY

PROFESSIONAL SUPPORT

100% ACCURANCY

MONEYBACK GUARANTEE

FAQs

The ITR 3 is applicable for individual and HUF who have income from profits and gains from business or profession. The persons having income from following sources are eligible to file ITR 3 :

- a. Carrying on a business or profession

- b. The return may include income from House property, Salary/Pension and Income from other sources

A taxpayer has to compulsorily file ITR-3 online. The ITR-3 can be filed Online/Electronically:

- By furnishing the return electronically under digital signature

- By transmitting the data electronically and then submitting the verification of the return in Return Form ITR-V

If you submit your ITR-3 Form electronically under digital signature, the acknowledgement will be sent to your registered email id. You can also choose to download it manually from the income tax website. You are then required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing. Remember that ITR-3 is an annexure-less form i.e. you do not have to attach any documents when you send it.

It is mandatory for you to furnish the return electronically if you fall in any of the following categories:

- Assessees with income from profit and gain of any business or profession

- Assessees having income from partnership firm

- Resident assessees having assets outside India

- Assessees claiming relief u/s 90, 90A or 91 for whom Schedule FSI & TR are applicable

ITR-3 cannot be filed in manual or paper form; it has to be mandatorily e-filed for all types of taxpayers.

General Instructions to Fill the Form

- All items must be filled in the correct manner or it can be held defective or even invalid.

- If any item is inapplicable, write “NA” against that item.

- Write “Nil” to denote nil figures.

- Except as provided in the form, for a negative figure/ figure of loss, write “-” before such figure.

- All figures should be rounded off to the nearest one rupee. However, the figures for total income / loss and tax payable be finally rounded off to the nearest multiple of ten rupees.

The structure of ITR 3 form is divided into 2 parts and 23 schedules:

- GEN: General information and Nature of Business

- BS: Balance Sheet as of March 31, 2018 of the Proprietary Business or Profession

- P & L: Profit and Loss for the Financial Year 2017-18

- OI: Other Information (optional if you are not eligible for audit under Section 44AB)

- QD: Quantitative Details (optional if you are not eligible for audit under Section 44AB)

- Part B summarizes the total income and tax computation with respect to income chargeable to tax.

.png)

ONLINE EASE LOCAL REACH

11565

11565Our Clients

88

88Services Area

25694

25694Registrations