ITR-2 Form Filing - Income Tax Return

ITR Form 2 is for Individuals and HUF receiving income other than income from “Profits and Gains from Business or Profession”. Thus persons having income from following sources are eligible to file Form ITR 2

- Income from House Property(Income Can be from more than one house property)

- Income from Capital Gains/loss on sale of investments/property (Both Short Term and Long Term)

- Income from Other Sources (including winning from Lottery, bets on Race Horses and other legal means of gambling)

- Foreign Assets/Foreign Income

- Agricultural Income more than Rs 5000

- Resident not ordinarily resident and a Non-resident

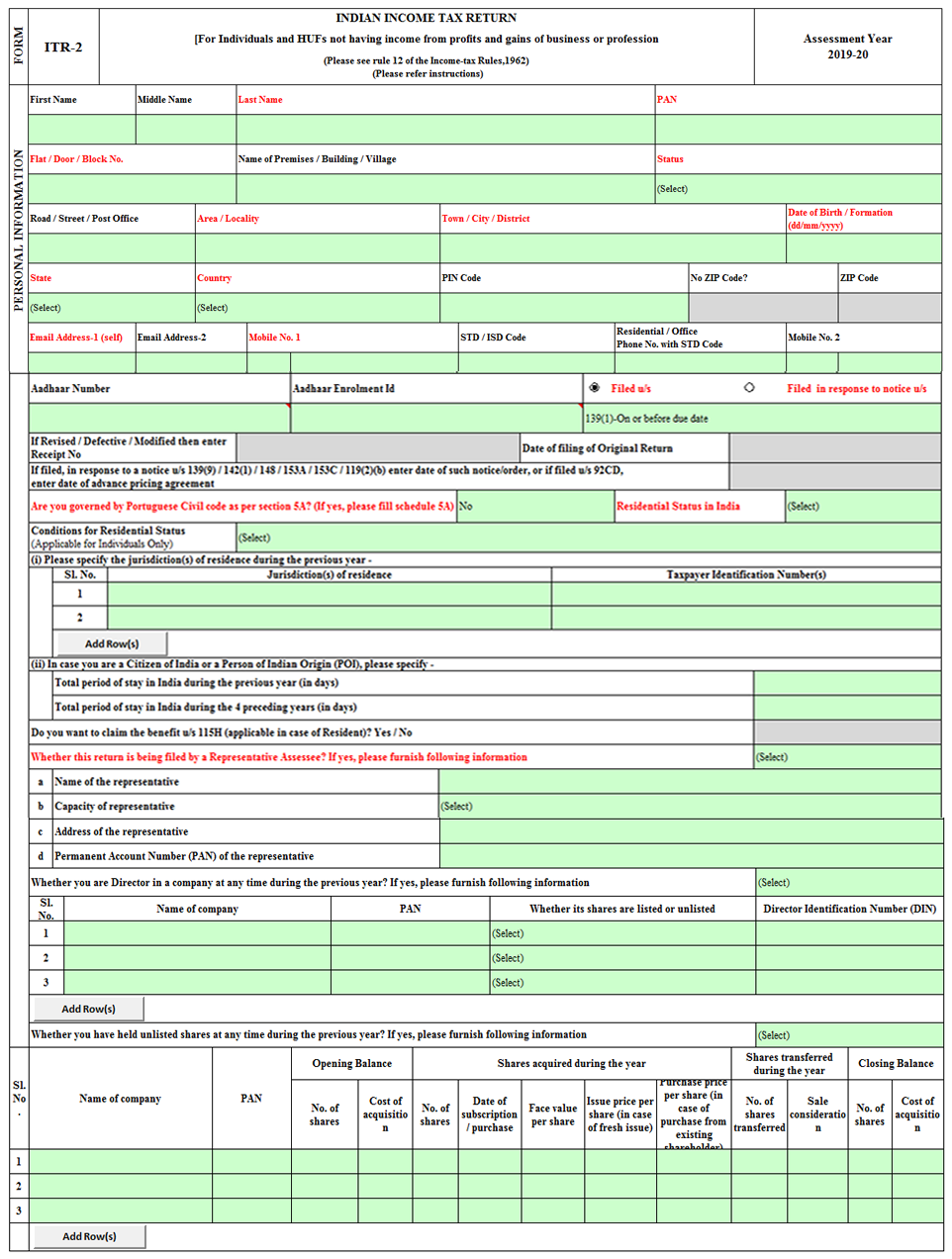

What is the Structure of ITR 2?

- Part A: General Information

- Part B-TI: Computation of Total Income

- Part B-TTI: Computation of tax liability on total income

- Details to be filled if the return has been prepared by a Tax Return Preparer

- Schedule S: Details of income from salaries

- Schedule HP: Details of income from House Property

- Schedule CG: Computation of income under Capital gains

- Schedule OS: Computation of income under Income from other sources

- Schedule CYLA: Statement of income after set off of current year’s losses

- Schedule BFLA: Statement of income after set off of unabsorbed loss brought forward from earlier years

- Schedule CFL: Statement of losses to be carried forward to future years

- Schedule VIA: Statement of deductions (from total income) under Chapter VIA

- Schedule 80G: Statement of donations entitled for deduction under section 80G

- Schedule SPI: Statement of income arising to spouse/ minor child/ son’s wife or any other person or association of persons to be included in the income of the assessee in Schedules-HP, CG and OS

- Schedule SI: Statement of income which is chargeable to tax at special rates

- Schedule EI: Details of Exempt Income

- Schedule PTI: Pass through income details from business trust or investment fund as per Section 115UA, 115UB

- Schedule FSI: Statement of income accruing or arising outside India.

- Schedule TR: Details of taxes paid outside India

- Schedule FA: Details of Foreign Assets

- Schedule 5A: Statement of apportionment of income between spouses governed by Portuguese Civil Code

- Schedule AL: Asset and liability at the year-end (applicable in case income exceeds Rs 50 lakhs)

WHAT IS THE STRUCTURE OF ITR 2?

Individuals who are of the age of 80 years or more.

By transmitting the data electronically and then submitting the verification of the return in Return Form ITR-V

Individual whose income is less than Rs 5 lakhs per year and who do not have to claim refund in the return.

By furnishing a bar-coded return, By furnishing a bar-coded return.

The Income Tax Department will issue you an acknowledgement at the time of submission of your physical paper return.

By furnishing the return electronically under digital signature, Online/Electronically

Income Tax Rate for Individuals – AY 2019-20

Individuals are required to file income tax return each year if they have taxable income of more than Rs.2.5 lakhs. The income tax rate AY 2019-20 or FY 2018-19 for salaried individuals is as follows.

Note: Financial year starts from 1st April and ends on 31st March. For example, the financial year 2018 – 19 would be 1st April 2018 to 31st March 2019. Assessment year is the year immediately following the financial year wherein the income of the financial year is assessed. Hence, in the assessment year 2019 – 20 the income tax for the period from 1st April 2018 to 31st March 2019 would be assessed.

Income Tax Rate for Individuals – AY (Current Year) 2019-20

- Income Tax Rate

AY 2019-20 | FY 2018-19

Individuals less than 60 years - TAXABLE INCOMETAX RATE

- Up to Rs. 2,50,000Nil

- Rs. 2,50,000 to 5,00,0005 %

- Rs. 5,00,000 to 10,00,00020%

- Above Rs. 10,00,00030%

- Income Tax Rate

AY 2019-20 | FY 2018-19

Individuals betwen 60 years and 80 years - TAXABLE INCOMETAX RATE

- Up to Rs. 3,00,000Nil

- Rs. 3,00,000 to 5,00,0005 %

- Rs. 5,00,000 to 10,00,00020%

- Above Rs. 10,00,00030%

- Income Tax Rate

AY 2019-20 | FY 2018-19

Individuals above 80 years - TAXABLE INCOMETAX RATE

- Up to 5,00,000Nil

- Rs. 5,00,000 to 10,00,00020%

- Above Rs. 10,00,00030%

- Above Rs. 10,00,00030%

Surcharge: 10% of income tax, where total income exceeds Rs.50 lakh up to Rs.1 crore.

Surcharge: 15% of income tax, where the total income exceeds Rs.1 crore.

Health & Education Cess: 4% of Income Tax. (Newly introduced through 2018 Budget)

Why Choose Chennai Filings ?

EASY TO ACCESS

BEST EXPERTS

TAX SAVING

LESS TIME

LOW COST IN INDUSTRY

PROFESSIONAL SUPPORT

100% ACCURANCY

MONEYBACK GUARANTEE

FAQs

ITR Form 2 is for Individuals and HUF receiving income other than income from “Profits and Gains from Business or Profession”. Thus persons having income from following sources are eligible to file Form ITR 2:

- Income from Salary/Pension

- Income from House Property(Income Can be from more than one house property)

- Income from Capital Gains/loss on sale of investments/property (Both Short Term and Long Term)

- IIncome from Other Sources (including winning from Lottery, bets on Race Horses and other legal means of gambling) Foreign Assets/Foreign Income

- Agricultural Income more than Rs 5000

- Resident not ordinarily resident and a Non-resident

- Income from more than one housing property

- Income from countries outside of India

- Income as a partner in any firm (not proprietorship)

- Income from agriculture above Rs 5,000

- Income from any windfall such as lotteries or horse racing

- Income from Salary/Pension, Housing Property, Other sources that exceeds Rs. 50 Lakhs

ITR-2 form must be filed by individuals and HUFs on or before 31st July of every year.

- In the Part A section of the form, you need to fill in all the general information

- The Part B-TI consists of details regarding the calculation of total income

- The Part B-TTI section of the form consists of calculation of tax liability on total income

- In the Schedule IT you need to mention details of advance tax and self-assessment tax payments

- The Schedule TDS1 of the form requires details of tax deducted at source and tax collected at source.

- Schedule TDSS2: This includes TDS details of income apart from salary sources [regarding Form 16A, issued to file Income tax]

- Other Supplementary Schedules like TDS1, TDS2 and IT

.png)

ONLINE EASE LOCAL REACH

11565

11565Our Clients

88

88Services Area

25694

25694Registrations